Introduction

When it comes to selecting your health plan, having peace of mind is essential. Common wisdom suggests that spending more on an expensive insurance plan offers better protection than a cheaper plan. Individuals are willing to pay a premium for a quality health plan to keep medical expenses under control. These are usually referred to as Platinum plans. It's no surprise that Platinum plans come with higher costs, much higher in fact. The idea is that if you ever need expensive medical care, you know you'll get your money's worth.

Is it possible that a less expensive Bronze plan could prove to be cheaper even when faced with high medical expenses? Under the Affordable Care Act, a maximum out-of-pocket (MOOP) limit was set for all qualified health plans. For the year 2023, this maximum was capped at $9,100, meaning that regardless of the plan, an individual will never pay more than $9,100 for in-network medical services, in addition to the plan premium.

Let's delve into reality and see in which scenarios a person might be better off with a Bronze plan instead of a Platinum plan.

Let’s compare medical needs

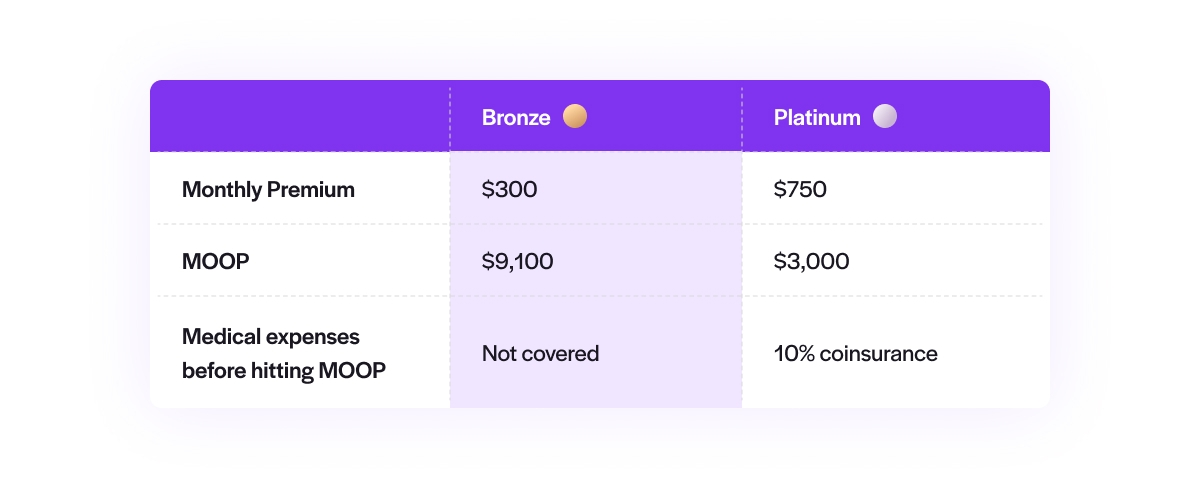

For the purpose of this exercise, let's consider two plans: a Bronze plan with a $9,100 MOOP (the maximum), where the individual covers all medical expenses until reaching it, and a Platinum plan with a lower MOOP of $3,000 and a tempting 10% coinsurance.

For the average 30-something year old, the Bronze plan's monthly premium is approximately $300, while the Platinum plan can be as high as $750 per month.

Here's a quick comparison:

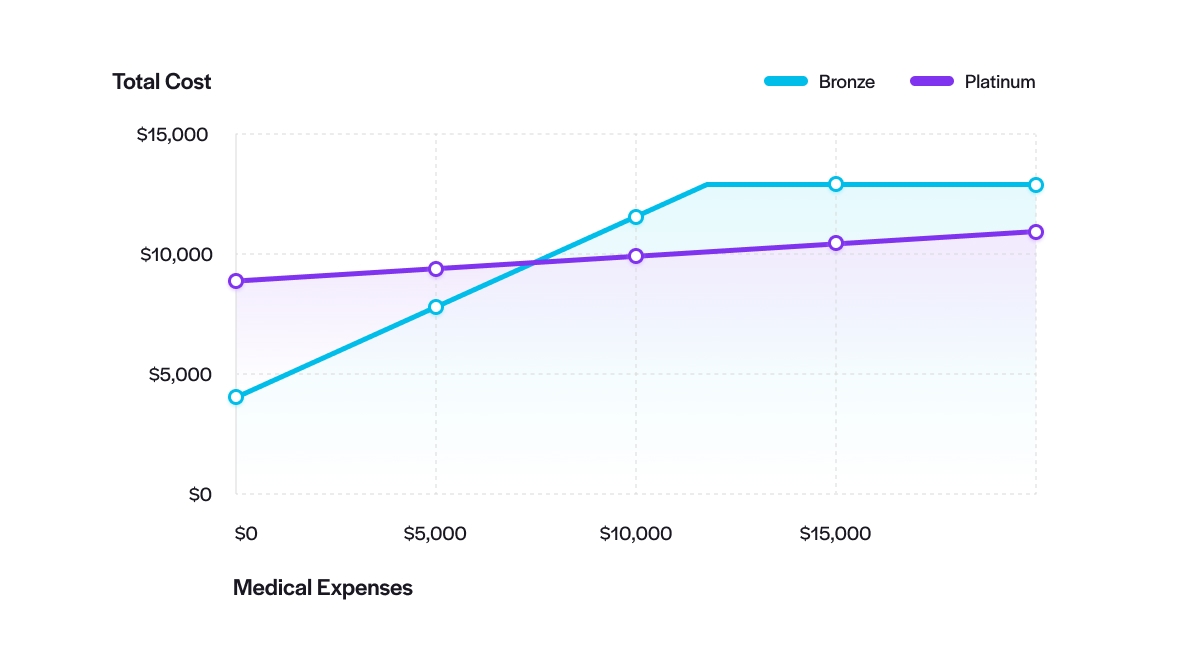

Looking at the chart, we see that the Total Cost for people with low-to-medium medical needs is cheaper with the Bronze plan and the Platinum plan is only cheaper for those with high medical needs ($6,000+)!

Let’s compare age brackets

As individuals get older, plan premiums also vary. For someone in their 50s, the premiums for our example plans rise to $470 for the Bronze plan and $1,175 for the Platinum plan.

.jpg&w=3840&q=100)

Surprisingly, with the increase in the plans’ premiums, the Total Cost using the Bronze plan is consistently lower regardless of the level of medical services needed. This is contrary to what one might expect, as Platinum plans are traditionally considered more cost-effective for older individuals.

So does this mean you should opt for the cheaper plan?

Not necessarily. There are various other factors to consider when selecting a health plan aside from Total Cost. For instance, you'll want to make sure that your preferred doctors and medications are covered, that there's a wide availability of care providers in your area, and whether you need a referral to see a specialist.

Conclusion: Use the experts!

At Zorro, we understand the importance of making a well-informed decision based on your specific health needs, family circumstances, budget, risk tolerance, personal preferences, and more.At Zorro we have simplified this for you. It is very difficult to compile all of this together, this is why we leverage our AI technology to stand with employers and employees to help you choose the right plan for your own needs.